Top 10 Ethereum Staking Validators - May 2023

Looking to stake your Ethereum? Check out our list of the top 10 Ethereum staking validators. Whether you're a seasoned staker or just getting started with Ethereum staking, this guide will help you find the right validator.

Ethereum Staking & Validator

Ethereum staking involves holding and locking up Ethereum (ETH) tokens over a specific period of time. This process aims to contribute to the network's security and functionality. In return, users earn rewards when participating in staking ETH.

Staking is part of the Proof-of-Stake consensus algorithm. The more ETH you stake, the higher your chances of being chosen as a validator and earning rewards. These rewards are typically distributed in ETH tokens and are proportional to the number of tokens staked.

How To Pick A Validator To Stake Ethereum

Here are four important things to consider when picking a validator to stake Ethereum:

- Reputation and track record: Look for validators with a good reputation and a proven reliability and security track record.

- Staking rewards: Check the staking rewards the validator offers and ensure they are competitive and fair. Avoid validators that offer overly high or suspiciously low rewards.

- Fees: Validators may charge a fee for their services, such as a percentage of the rewards earned. Make sure to compare fees between validators and choose one with reasonable fees.

- Performance and uptime: Validators should have strong server infrastructure and be able to maintain high uptime to ensure that your staked tokens are always working to support the network. Look for validators with a history of consistent performance and minimal downtime.

Warning: Ethereum validators selected in this post are only relevant for the time of writing, as the state of validators can change at any time. The list below is chosen based on Blockmeadow's perspective - always do your due diligence. Highly recommend everyone always monitor staking rewards.

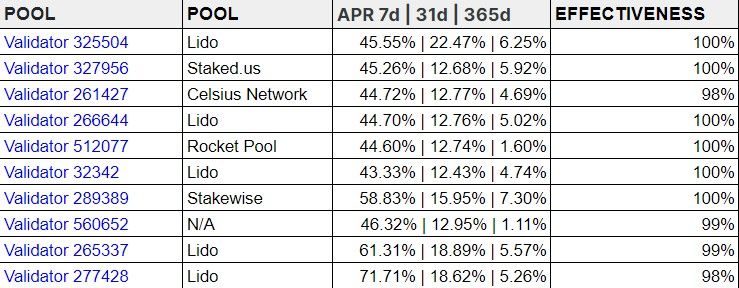

Top 10 Ethereum Staking Validators

The best Ethereum validators are chosen based on compass score, APY, and commission fee. The current annual yield on staking Ethereum is around 7.3%.

Commission fee note:

- Lido: Lido charges a 10% fee for staking Ethereum. However, this fee is split between the validators and the Lido DAO, with 80% going to validators and 20% going to the DAO.

- Staked.us: Staked.us charges a variable commission fee depending on the size of your stake. The fee ranges from 7% to 13%, with larger stakes generally receiving a lower fee.

- Stakewise: Stakewise charges a 10% fee for staking Ethereum. However, this fee is reduced to 5% if you participate in the Stakewise governance process.

- Rocket Pool: Rocket Pool charges a variable commission fee depending on the size of your stake and the number of validators you choose to use. The fee ranges from 5% to 10%.

- Celsius Network: Celsius Network charges a 25% fee for staking Ethereum. However, this fee is reduced to 0% if you stake CEL tokens, the platform's native cryptocurrency.

Is ETH Worth Staking?

The Ethereum network recently underwent a major upgrade known as Ethereum 2.0, which introduced a new consensus mechanism called Proof of Stake (PoS). With PoS, users can now stake their Ethereum to help secure the network and earn rewards.

It's important to evaluate your own financial situation and investment goals carefully. You should also research and choose a reputable validator with a proven track record and competitive fees.

Popular Tags : Top Ethereum Staking Validators in May 2023, Ethereum staking validators, Ethereum staking, Ethereum tokens, ETH tokens, Ethereum network