Top 10 The Graph Validators (Indexers) - May 2023

Discover the top 10 The Graph validators (indexers) for May 2023 and learn key metrics for selecting the right validators to stake your GRT.

The Graph Overview

As the volume and complexity of blockchain data continue to grow, a crucial need arises for efficient indexing and querying systems. The Graph steps in with a powerful solution to navigate and extract valuable insights from the vast ocean of blockchain data.

The Graph is a decentralized protocol that aims to make it easier for developers to access and analyze data from various blockchain networks. It acts as an indexing and querying protocol, providing a more efficient way to query specific information from blockchain data.

Here are The Graph's key features:

- Data Indexing: The Graph indexes and organizes data from various blockchains like Ethereum, making it easy to search for specific information. Think of it as Google of blockchain data.

- Subgraph Creation: Developers use The Graph to create "subgraphs" that define specific data entities and their relationships extracted from the blockchain. Subgraph allows developers to define what data they want to track and how they want to query it.

- Data Processing: Once a subgraph is created, The Graph efficiently processes blockchain data, extracting relevant information based on the defined subgraph. This streamlines the developer's workflow, reducing costs and improving efficiency.

- Querying the Graph: Developers can then use The Graph's query language, GraphQL, to fetch specific data from the indexed blockchain data. GraphQL provides a flexible and intuitive way to request data, allowing developers to retrieve precisely what they need without going through the entire blockchain.

- Developer Tools and Marketplace: The Graph provides developer tools and a marketplace where developers can share their subgraphs with others. This enables collaboration and allows developers to build on each other's work, accelerating the development of decentralized applications (dApps) and services.

The Graph Staking

The Graph staking, or delegating, involves locking up a certain amount of Graph Tokens (GRT), the native cryptocurrency of The Graph, to support the network's operations. By staking GRT, individuals become active participants in the consensus mechanism, ensuring the integrity and reliability of the data indexing process.

Importance of Graph Staking:

- Network security: Staking GRT enhances the security of The Graph network by incentivizing participants to act honestly. Stakers are required to validate and curate data accurately, preventing malicious actors from manipulating the indexing system.

- Reward opportunities: Staking GRT offers the potential to earn rewards, with stakers receiving additional GRT tokens for their contributions to the network. This incentivizes active participation and aligns stakers' interests with the ecosystem's success.

Tactics to Maximize Graph Staking Success

- Research and select a reliable staking provider: Select a reputable node operator known for his security and reliability. Opt for ones offering competitive rewards and transparent fee structures.

- Optimal token allocation: Carefully consider the amount of GRT tokens to stake. Assess the risks and rewards associated with different staking options. Diversifying your stake across multiple providers can also help mitigate potential risks.

- Stay informed: Keep yourself updated with the latest developments, protocol upgrades, and governance proposals related to The Graph. Active engagement within the community allows for a better understanding of the platform and potential opportunities for optimization.

- Long-term perspective: Staking GRT often requires a lock-up period, during which the tokens cannot be easily accessed or traded. Adopt a long-term perspective and evaluate your staking strategy based on your investment goals and risk tolerance.

How to Select an Indexer to Stake Graph Token (GRT)

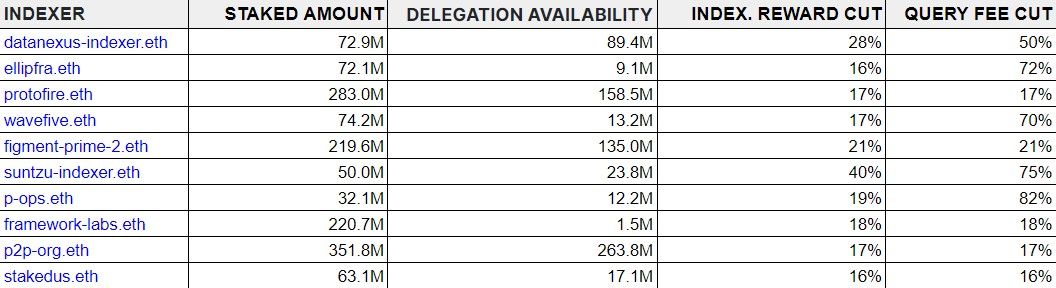

When selecting an Indexer to delegate your GRT tokens, pay specific attention to the following key metrics:

- Staked amount: The total amount of Graph tokens delegated to a specific indexer in The Graph network.

- Max capacity: The upper limit of GRT tokens that can be received by the indexer from delegators.

- Indexing reward cut: The portion of total rewards earned by an indexer that they get to keep. For example, if the indexing reward cut is 28%, the indexer keeps 80% of their rewards and shares 20% with their delegators.

- Query fee cut: The portion of query fee rebates that an indexer. For example, if the query fee cut is 17%, the indexer keeps 17% of the query fees earned and shares 83% with their delegators.

- Delegation availability: The remaining capacity or space an indexer has to accept additional GRT tokens from delegators. It represents the amount of GRT that can still be delegated to the indexer before reaching its maximum capacity or limit.

Disclaimer: The Graph indexers selected in this post are only relevant for the time of writing as the state of validators can change at any point in time. The below-selected list is chosen based on personal opinion factors, and you should always do your due diligence.

Top 10 The Graph Validators (Indexers) - May 2023

Currently, delegators can earn up to 11% when staking Graph tokens. To calculate the exact The Graph staking rewards, read more here.

Is The Graph Worth Staking?

Whether to stake The Graph (GRT) ultimately depends on your risk tolerance and investment strategy. The Graph's vision and mission are exceptionally distinctive and hold significant potential.

As a decentralized indexing and querying protocol, The Graph addresses a critical need in the blockchain ecosystem. Its innovative approach to organizing and retrieving data has garnered attention and adoption from various projects and developers.

Considering these factors, staking The Graph has the potential to be a compelling opportunity. Nonetheless, thorough research and careful consideration of your financial circumstances are essential before making investment decisions.

Where is the best place to stake The Graph?

Determining the best place to stake The Graph (GRT) depends on your specific requirements and preferences. There are several major platforms and exchanges that offer staking services for GRT. Staking directly on The Graph Explorer with MetaMask is also common.

What are the risks of staking GRT?

Staking GRT carries risks such as market volatility, slashing penalties, network vulnerabilities, centralization risks, and smart contract risks. Assessing your risk tolerance and conducting thorough research before staking GRT is important.

Can you stake Graph on Binance?

Yes, you can stake Graph tokens on Binance. In addition to Binance, you can check out other best staking platforms for GRT tokens.

Popular Tags : Graph validators, Graph staking, Graph delegating, Graph Tokens