Top 10 Cardano Validators - June 2023

Staking Cardano (ADA) is a great way to earn passive income and get started with the system's interaction for beginners. In this article, we will explore the top 10 Cardano validators for June 2023, considering their reputation, performance, security measures, and community involvement.

Cardano Staking & Validators

Cardano blockchain is renowned for its new Proof-of-Stake (PoS) consensus algorithm - Ouroboros. With staking playing an integral part of its ecosystem, validators play a vital role in ensuring the stability and security of the Cardano blockchain.

Staking Cardano involves holding and delegating ADA tokens to validators, who secure the network and validate transactions. Delegators earn rewards in proportion to their delegated stake.

Validators on the Cardano network are responsible for producing new blocks, validating transactions, and participating in the decentralized governance of the blockchain. By choosing a reliable and reputable validator, stakers can increase their chances of earning consistent rewards and contributing to the network's overall health.

How to Choose a Validator for Staking Cardano (ADA)

Here are five aspects to consider when staking Cardano (ADA) with validators.

- Analysis tools: Use performance analysis tools to assess validators' historical performance, including block production efficiency, stake pool size, and rewards distribution. This data provides insights into their reliability and efficiency.

- Technical infrastructure: Consider validators with robust and scalable hardware setups, redundancy measures, and advanced monitoring systems. A well-maintained infrastructure ensures consistent performance and the ability to handle network fluctuations.

- Rewards distribution model: Consider validators with unique rewards distribution models that align with your preferences. Consider factors such as frequency of rewards distribution or additional benefits offered.

- Validator's stake: Evaluate the validator's personal stake in their own pool. Validators with a significant personal stake are more likely to be committed to maintaining performance and security.

- Communication channels: Assess the validator's communication channels and transparency. Look for validators with active social media accounts, regular newsletters, or dedicated platforms for updates and responding to stakers' queries or concerns.

Top 10 Cardano Validators - June 2023

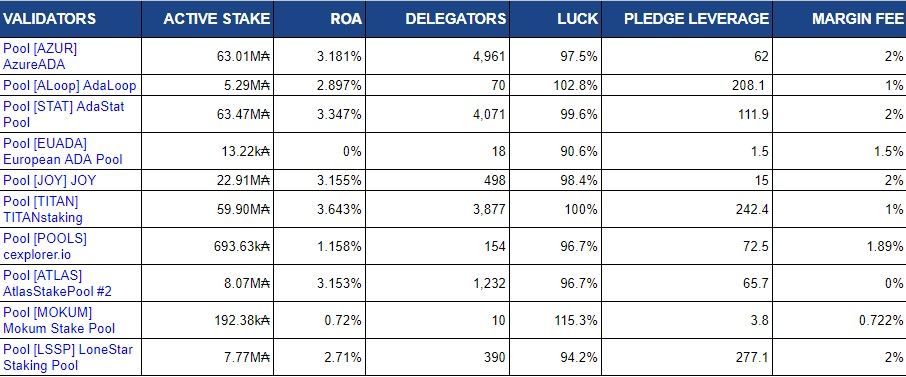

The best Cardano validators are chosen based on lifetime luck, recent ROA, commission fee, margin fee, pledge leverage, and active stake. The current annual yield on staking Cardano is around 7.3%.

Here is the list of the top 10 Cardano validators for June 2023.

Metrics Explained:

- Active stake: The active balance on the pledge address.

- ROA: Recent annual return of ADA based on staking results on the last 10 epochs. It's noteworthy that it's not a lifetime ROA.

- Delegators: The amounts of people who delegate their ADA. Only accounts with at least 10 ADA in live balance are counted.

- Luck: The measure of a validator's performance relative to the expected average performance. It helps determine whether a validator is producing blocks and earning rewards as expected.

- Pledge leverage: Ration between total stake and operator pledge. High leverage could indicate little 'skin in the game.'

- Margin fee: The percentage of staking rewards the validator charges for their services.

FAQs

Is it worth staking Cardano?

Staking Cardano can be worth it for ADA holders seeking passive income. By participating in staking, you can contribute to the security and decentralization of the Cardano network while earning rewards in return.

How much can you make staking Cardano?

The amount you can earn from staking Cardano depends on factors such as the amount of ADA you stake, the current staking rewards, and the performance of the chosen validator. Currently, the average annual yield for staking Cardano is around 7.3%. However, it's important to note that staking rewards are subject to change and can vary based on network dynamics.

Is staking Cardano risky?

Staking Cardano carries some inherent risks. While the risk of losing your staked ADA is relatively low, other factors should be considered. For example, validators may face technical issues or even suffer from slashing penalties if they fail to comply with the network's rules. Additionally, the value of ADA itself can fluctuate in the market, impacting the overall value of your staked assets.

Can you withdraw Cardano staking?

You can withdraw your staked ADA anytime, given that there is no lock-up period. However, it's important to note that there may be a delay in receiving your staked ADA due to the nature of the Cardano network's protocol.

You will pay around 0.17 ADA transaction fee to withdraw your stake.

Popular Tags : Staking Cardano, Cardano validators, Cardano blockchain, ADA, Cardano Staking & Validators